TAXES

With one of the lowest corporate tax rate in the world (10%), Timor-Leste presents a unique business environment for any investor. The country does not use VAT yet and only levies a small 2.5% sales tax on imported taxable goods (taxable goods and services sold and delivered in Timor-Leste are subject to 0% rate).

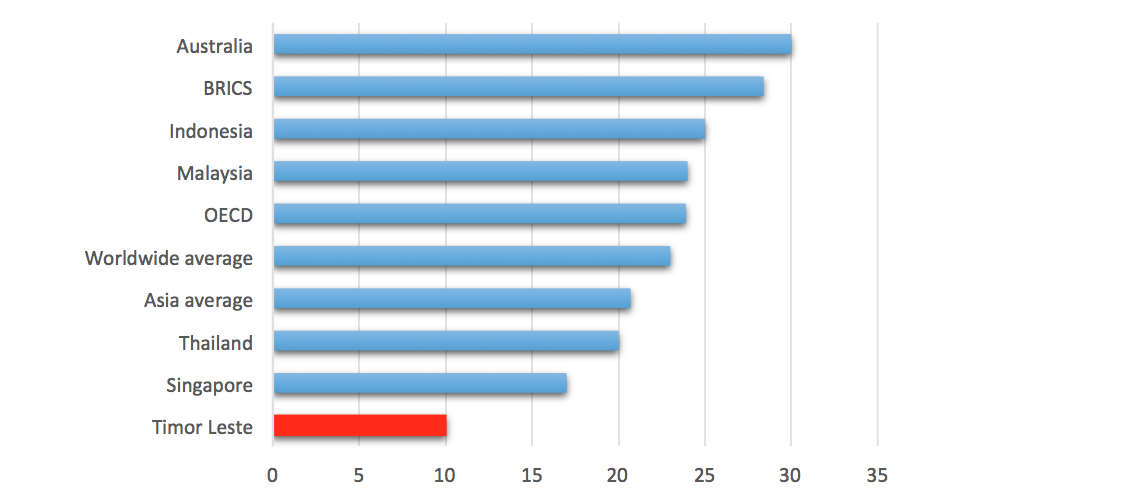

Timor-Leste is among twenty countries with the lowest corporate income tax rates in the world

Source: International Tax Competitiveness Index, Tax Foundation, 2018

(https://taxfoundation.org/corporate-tax-rates-around-world-2018)

The following fees and tax liabilities apply in Timor-Leste:

| Company income tax | 10% rate |

|---|---|

| Personal income tax | progressive rate from 0 to 10% |

| Wage income tax | progressive rate from 0 to 10% |

| Withholding tax | varies between 2% to 10% |

| Sales tax | 2.5% rate applied to imported taxable goods (taxable goods and services sold and delivered in East Timor are subject to 0% rate) |

| Service tax | 5% rate applied to hospitality services, restaurant and bar, and telecommunications with the monthly turnover exceeding US$500 |

| Customs duties on imports | 2.5% rate on the value of imported goods |

Source: Taxation, Timor Leste Ministry of Finance, 2019 (www.mof.gov.tl/taxation)

For details on East Timor taxation system, tax filling and settlement system, download TradeInvest’s factsheet:

![]() 01. Factsheet Corporate Taxation

01. Factsheet Corporate Taxation

![]() 02. Factsheet Personal Taxation

02. Factsheet Personal Taxation